5 Things Your Will CAN’T Do: Why You Need a Comprehensive Estate Plan

When you think of estate planning, a will may be the first thing that comes to mind. However, a will is only one small part of a comprehensive estate plan.…

Can a Creditor Reach My Joint Bank Account?

When it comes to protecting your wealth, one important question is whether creditors can access funds held in a joint bank account. If you are concerned about safeguarding your financial…

What Assets Are Protected if Someone Sues Me in Florida?

The results of a lawsuit can be devastating, leading to the loss of the personal assets you have worked so hard to amass. Fortunately, Florida law provides strong legal protections…

CHOICE Act Goes into Effect for Florida Employers

Florida has enacted the Contracts Honoring Opportunity, Investment, Confidentiality, and Economic Growth (CHOICE) Act, found at Fla. Stat. §§ 542.41 – 542.45. The CHOICE Act, which went into effect on…

Mistakes to Avoid When Leaving an Inheritance to Your Child

Passing down wealth to your children through inheritance is one of the most meaningful aspects of estate planning—but it’s also one of the most misunderstood. While it may seem straightforward…

Is a Trust a Good Means of Asset Protection?

Life is unpredictable—and so is financial risk. These risks make asset protection critical. A single car accident, an economic downturn, or a business closure can trigger lawsuits, debt, and creditor…

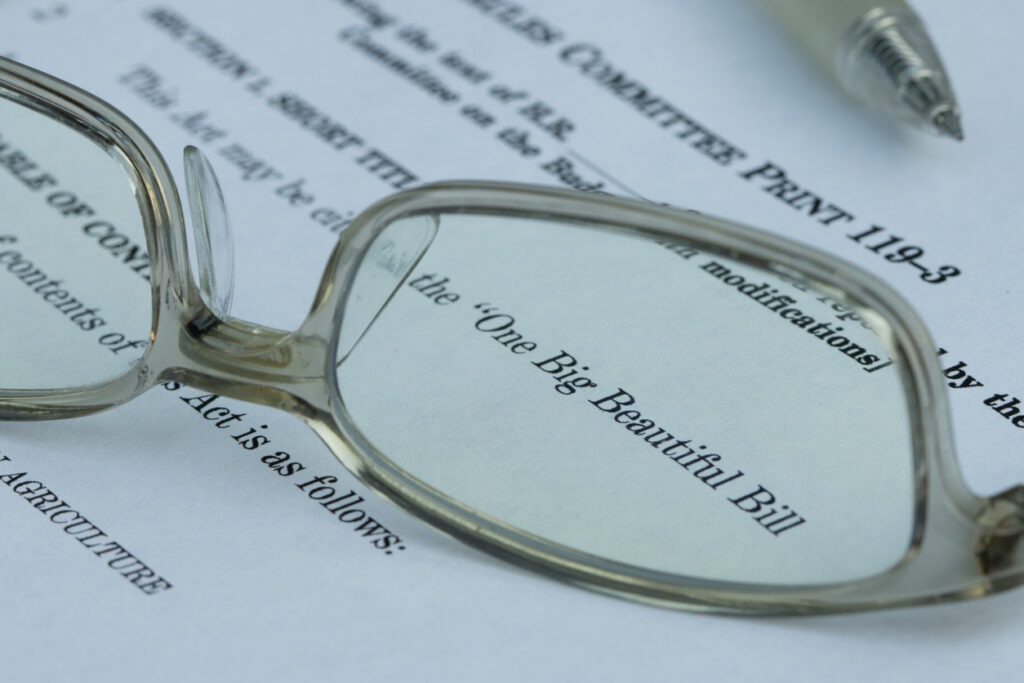

High Net Worth Individuals: Benefits Under the New Federal Tax Bill

The potential tax savings for high net worth individuals is a major feature of President Donald Trump’s “One Big Beautiful Bill Act.” Wealthy taxpayers should be aware of these opportunities…

Retirement Planning and the New Tax Bill: What You Should Know

President Donald Trump’s “One Big Beautiful Bill,” which became law on July 4, 2025, has significant implications for retirement planning. The new bill includes various tax changes at the federal…

The New Federal Tax Law: Taxes for Businesses

A major feature of President Donald Trump’s “One Big Beautiful Bill Act” is the tax savings for businesses. Business owners should be aware of these potential tax savings and ensure…

How Will the New Federal Tax Bill Affect My Estate Planning?

President Donald Trump signed the new federal tax bill, also known as the “One Big Beautiful Bill Act,” into law on July 4, 2025. The new bill contains various changes…